Market Update - Russia-Ukraine Crisis

Friends,

We have many opinions and feelings about Russia’s invasion of Ukraine. Our prayers go out to a nation and its people who are in distress.

Our job is to consider the impact on financial markets, so we are sharing with you some thoughts. Keep in mind this is a constantly evolving situation.

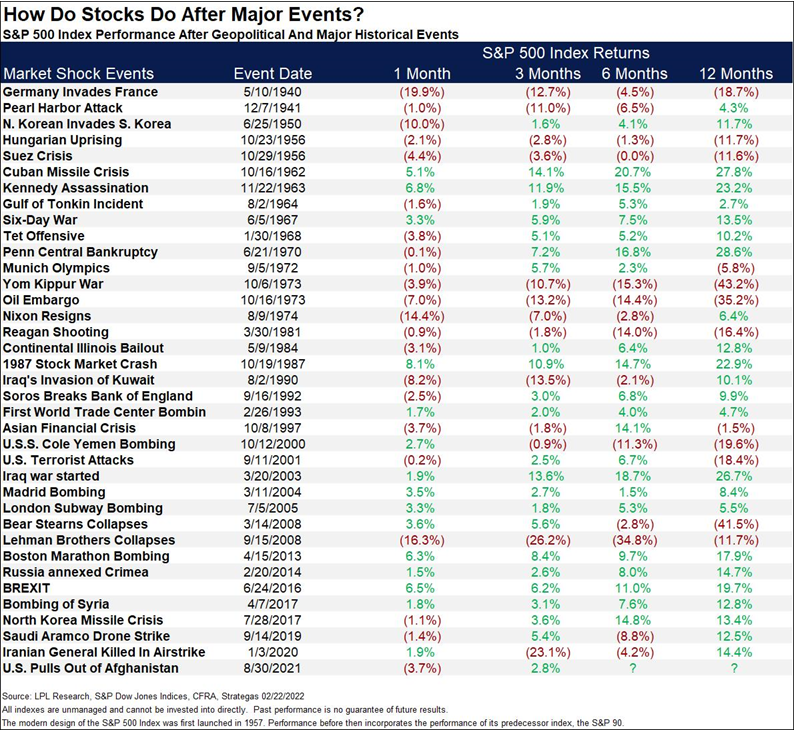

Let’s look at the history of markets after major events. As you can see from the table below, the results were as diverse as the events. It is important to keep in mind what was going on before the date of the event is not shown. Where you start from matters. The health of markets and economic conditions leading up to the events varied greatly.

Forecasting markets and economics is always challenging but has suddenly become especially cloudy. When we are considering an event's impacts on markets we attempt to ignore our feelings and determine how the situation will impact the earnings of companies. This is important because in the short-term markets can be driven by emotions, but in the long-term earnings are what make companies valuable. We are monitoring several things closely right now.

- Interest rates

- Low-interest rates on debt impact the attractiveness of other investments and the actual valuation of most investments. Rates were slowly headed higher, but that path is suddenly less clear due to global economic uncertainty.

- Energy costs

- Russia supplies roughly 10% of the world’s oil. The flow of oil and gas could be disrupted by sanctions from the west, or Russian retaliation to Western sanctions, but also by lack of financing of energy trading by nervous banks. A coordinated increase in production by the US and Saudi Arabia might push down the price of oil, but a recession caused by a spike in energy prices remains a risk. Owning energy companies helps counter this risk.

- Expansion of the war

- If the war moves beyond Ukraine, fear, economic concerns, and volatility will increase. The war may end quickly, last a long time, or even expand, but economies will ultimately resume normal functioning even if the world changes.

In Conclusion

We are always considering adjustments to your portfolio, but generally, we will remain diversified and stay invested. This produces a higher probability of success than trying to read and act on the “tea leaves” regarding geopolitical events and other issues.

If you have thoughts or questions about any of the information we’ve shared or any other subject, please don’t hesitate to call us. We are grateful you allow us to serve you and your family, and we will continue to make every effort to justify the trust you’ve bestowed on us.

Sincerely,

Your CCA Investment Team