Real Solutions for Investing

Proven Principles— Progressive Approach

Some would say the only change in investing over the past 100 years is air conditioning. We agree. Many aspects of markets have remained constant, but in some ways both risks and opportunities have evolved.

Traditionally, blending together different asset classes, (stocks, bonds, real estate, cash), has been the primary tool for building a diversified investment portfolio. While asset allocation is as important today as ever, approaching it through multiple investment strategies adds an even greater level of diversification. Understanding and respecting the impact of both asset and strategy diversification led us to develop our Multi-Asset/Multi-Strategy approach to portfolio construction.

You may ask how this sets us apart from other investment advisors, and how our approach may be the best fit for you. It all comes down to one word: diversity. Many advisors are zealously committed to one philosophy of investment management. Some adhere to a buy and hold approach, making adjustments when asset allocations shift from their intended weight. Others are devoted to looking ahead and trying to position for risks and opportunities they see in the future. Still others focus on one specific opportunity. The common denominator is singularity; they focus on one strategy and are thus limited. On the contrary, we are not singularly committed any one philosophy. Our commitment is to seeing you reach your goals, therefore our process is designed to reduce the potential a single strategy negatively impacts your goals.

Guided by your goals, we create custom portfolios by blending both asset classes and strategies. We begin by selecting from strategies which are self-contained, with their own purpose and mandate. These strategies are then overlaid to provide appropriate asset class diversification. The result is a truly customized portfolio. Your situation and objectives are unique and best served by a portfolio designed uniquely for you. We believe you will find our Multi-Asset/Multi-Strategy approach provides a sound foundation for pursuing your goals.

Multi-Asset / Multi-Strategy

Diversification should involve not just asset allocation strategies but also your overall investment approach as it relates to different investment strategies, such as active and passive investing. We blend components of different investment strategies so that they support each other in an integrated process based on your goals and your risk management strategy.

The financial planning process is the foundation, giving us a clear understanding of who you are and where you want to go. Basing investment strategies on the financial planning process results in a holistic wealth management program that takes into account all facets of your life. --more--

Our approach is guided by three primary considerations:

- Preservation – Protecting against financial reverses, minimizing investment risk, preserving wealth.

- Growth – Building assets by balancing risk and return, focusing on stable investments to offset inflation.

- Aspiration – Increasing opportunities, taking measured risks, focusing on creating new wealth.

Multi-Asset Diversification

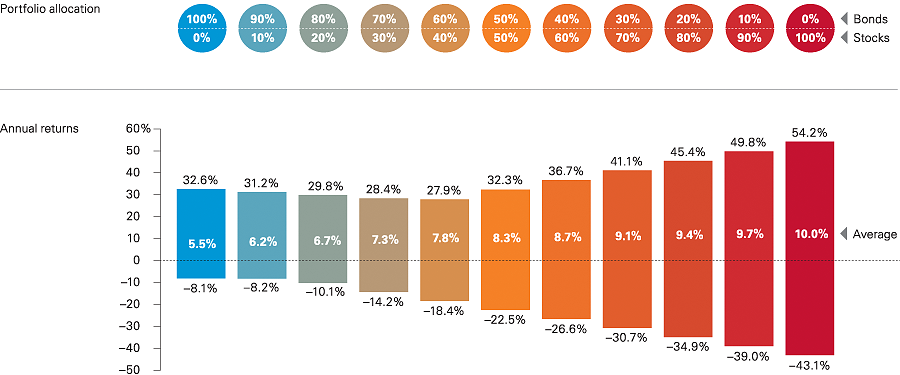

Risk and reward are related. Academic studies have shown major asset classes can be blended together, creating portfolios which range from lower volatility and lower expected return to higher volatility and higher expected return. Your appropriate asset allocation is dependent on your goals.

Best, worst, and average returns for various stock/bond allocations, 1926–2012

Note: Stocks are represented by the Standard & Poor's 90 Index from 1926 to March 3, 1957; the S&P 500 Index from March 4, 1957, through 1974; the Wilshire 5000 Index from 1975 through April 22, 2005; and the MSCI US Broad Market Index thereafter. Bonds are represented by the S&P High Grade Corporate Index from 1926 to 1968; the Citigroup High Grade Index from 1969 to 1972; the Barclays U.S. Long Credit AA Index from 1973 to 1975; and the Barclays U.S. Aggregate Bond Index thereafter. Data are through December 31, 2012. Source: Vanguard.

Multi-Strategy Diversification

Instead of singularly committing to one particular philosophy or strategy, we add diversity through blending strategies. Our commitment is to seeing you reach your goals, therefore our process is designed to reduce the potential a single strategy negatively impacts your goals. Strategies are self-contained, with their own purpose and mandate. When blended together, the result is a truly customized portfolio, providing a sound foundation for pursuing your goals.

There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance is no guarantee of future results. Please note that individual situations can vary. Therefore, the information presented here should only be relied upon when coordinated with individual professional advice.